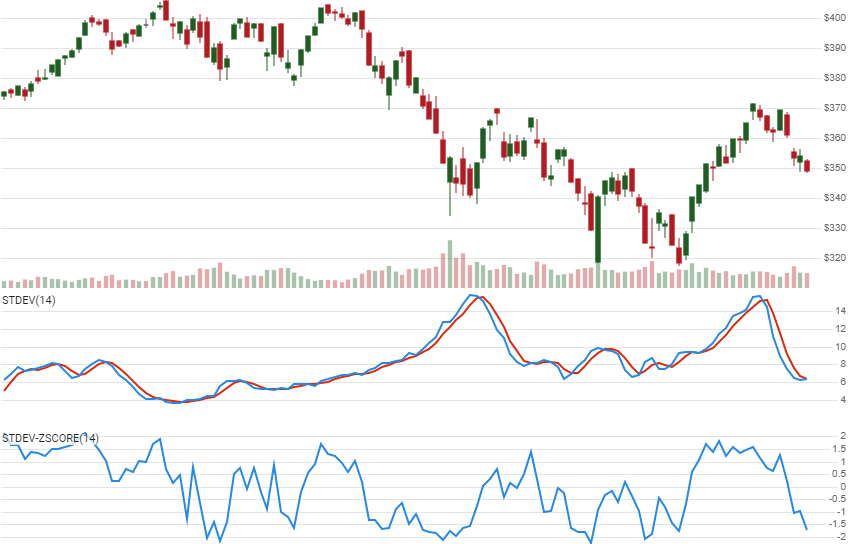

Standard Deviation (volatility)

get_stdev(quotes, lookback_periods, sma_periods=None)

Parameters

| name | type | notes |

|---|---|---|

quotes | Iterable[Quote] | Iterable of the Quote class or its sub-class. • See here for usage with pandas.DataFrame |

lookback_periods | int | Number of periods (N) in the lookback period. Must be greater than 1 to calculate; however we suggest a larger period for statistically appropriate sample size. |

sma_periods | int, Optional | Number of periods in the moving average of Stdev. Must be greater than 0, if specified. |

Historical quotes requirements

You must have at least N periods of quotes to cover the warmup periods.

quotes is an Iterable[Quote] collection of historical price quotes. It should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

Return

StdevResults[StdevResult]

- This method returns a time series of all available indicator values for the

quotesprovided. StdevResultsis just a list ofStdevResult.- It always returns the same number of elements as there are in the historical quotes.

- It does not return a single incremental indicator value.

- The first

N-1periods will haveNonevalues since there’s not enough data to calculate.

StdevResult

| name | type | notes |

|---|---|---|

date | datetime | Date |

stdev | float, Optional | Standard Deviation of Close price over N lookback periods |

mean | float, Optional | Mean value of Close price over N lookback periods |

z_score | float, Optional | Z-Score of current Close price (number of standard deviations from mean) |

stdev_sma | float, Optional | Moving average (SMA) of STDDEV based on sma_periods periods, if specified |

Utilities

See Utilities and Helpers for more information.

Example

from stock_indicators import indicators

# This method is NOT a part of the library.

quotes = get_historical_quotes("SPY")

# Calculate 10-period Standard Deviation

results = indicators.get_stdev(quotes, 10)

About Standard Deviation (volatility)

Standard Deviation of Close price over a rolling lookback window. Also known as Historical Volatility (HV). [Discuss] 💬