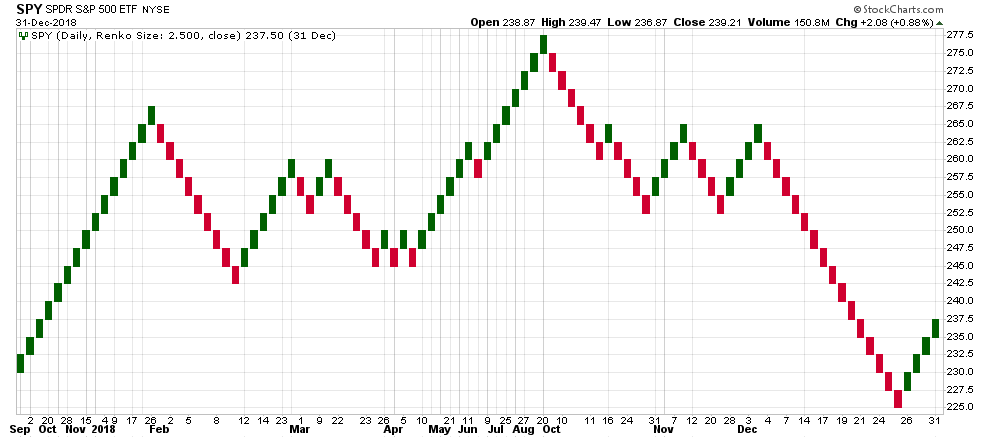

Renko Chart

get_renko(quotes, brick_size, end_type=EndType.CLOSE)

Parameters

| name | type | notes |

|---|---|---|

quotes | Iterable[Quote] | Iterable of the Quote class or its sub-class. • See here for usage with pandas.DataFrame |

brick_size | float | Brick size. Must be greater than 0. |

end_type | EndType, default EndType.CLOSE | See EndType options below. |

Historical quotes requirements

You must have at least two periods of quotes to cover the warmup periods; however, more is typically provided since this is a chartable candlestick pattern.

quotes is an Iterable[Quote] collection of historical price quotes. It should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

EndType options

from stock_indicators.indicators.common.enums import EndType

| type | description |

|---|---|

CLOSE | Brick change threshold measured from close price (default) |

HIGH_LOW | Brick change threshold measured from high and low price |

Return

RenkoResults[RenkoResult]

- This method returns a time series of all available indicator values for the

quotesprovided. RenkoResultsis just a list ofRenkoResult.- It does not return a single incremental indicator value.

🚩 Warning: Unlike most indicators in this library, this indicator DOES NOT return the same number of elements as there are in the historical quotes. Renko bricks are added to the results once the

brickSizechange is achieved. For example, if it takes 3 days for a $2.50 price change to occur an entry is made on the third day while the first two are skipped. If a period change occurs at multiples ofbrickSize, multiple bricks are drawn with the sameDate. See online documentation for more information.

RenkoResult

Each result record represents one Renko brick.

| name | type | notes |

|---|---|---|

date | datetime | Formation date of brick(s) |

open | Decimal | Brick open price |

high | Decimal | Highest high during elapsed quotes periods |

low | Decimal | Lowest low during elapsed quotes periods |

close | Decimal | Brick close price |

volume | Decimal | Sum of Volume over elapsed quotes periods |

is_up | bool | Direction of brick (true=up,false=down) |

🚩 Warning: When multiple bricks are drawn from a single

quoteperiod, the extra information aboutHighandLowwicks andVolumeis potentially confusing to interpret.HighandLowwicks will be the same across the multiple bricks; andVolumeis portioning evenly across the number of bricks. For example, if within onequoteperiod 3 bricks are drawn, theVolumefor each brick will be(sum of quotes Volume since last brick) / 3.

Utilities

See Utilities and Helpers for more information.

Example

from stock_indicators import indicators

from stock_indicators import EndType # Short path, version >= 0.8.1

# This method is NOT a part of the library.

quotes = get_historical_quotes("SPY")

# Calculate

results = indicators.get_renko(quotes, 2.5, EndType.CLOSE);

ATR Variant

get_renko_atr(quotes, atr_periods, end_type=EndType.CLOSE)

Parameters for ATR

| name | type | notes |

|---|---|---|

atr_periods | int | Number of lookback periods (A) for ATR evaluation. Must be greater than 0. |

end_type | EndType, default EndType.CLOSE | See EndType options. |

Historical quotes requirements for ATR

You must have at least A+100 periods of quotes.

quotes is an Iterable[Quote] collection of historical price quotes. It should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

Return for ATR

RenkoResults[RenkoResult]

- This method returns a time series of all available indicator values for the

quotesprovided. RenkoResultsis just a list ofRenkoResult.- It always returns the same number of elements as there are in the historical quotes.

- It does not return a single incremental indicator value.

👉 Repaint warning: When using the

GetRenkoAtr()variant, the last Average True Range (ATR) value is used to setbrickSize. Since the ATR changes over time, historical bricks will be repainted as new periods are added or updated inquotes.

Example for ATR variant

from stock_indicators import indicators

# This method is NOT a part of the library.

quotes = get_historical_quotes("SPY")

# Calculate

results = indicators.get_renko_atr(quotes, atr_periods);

About Renko Chart

The Renko Chart is a Japanese price transformed candlestick pattern that uses “bricks” to show a defined increment of change over a non-linear time series. Transitions can use either close or high/low price values. An ATR variant is also provided where brick size is determined by Average True Range values. [Discuss] 💬