Kaufman’s Adaptive Moving Average (KAMA)

get_kama(quotes, er_periods=10, fast_periods=2, slow_periods=30)

Parameters

| name | type | notes |

|---|---|---|

quotes | Iterable[Quote] | Iterable of the Quote class or its sub-class. • See here for usage with pandas.DataFrame |

er_periods | int, default 10 | Number of Efficiency Ratio (volatility) periods (E). Must be greater than 0. |

fast_periods | int, default 2 | Number of Fast EMA periods. Must be greater than 0. |

slow_periods | int, default 30 | Number of Slow EMA periods. Must be greater than fast_periods. |

Historical quotes requirements

You must have at least 6×E or E+100 periods of quotes, whichever is more, to cover the convergence periods. Since this uses a smoothing technique, we recommend you use at least 10×E data points prior to the intended usage date for better precision.

quotes is an Iterable[Quote] collection of historical price quotes. It should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

Return

KAMAResults[KAMAResult]

- This method returns a time series of all available indicator values for the

quotesprovided. KAMAResultsis just a list ofKAMAResult.- It always returns the same number of elements as there are in the historical quotes.

- It does not return a single incremental indicator value.

- The first

N-1periods will haveNonevalues since there’s not enough data to calculate.

⚞ Convergence warning: The first

10×Eperiods will have decreasing magnitude, convergence-related precision errors that can be as high as ~5% deviation in indicator values for earlier periods.

KAMAResult

| name | type | notes |

|---|---|---|

date | datetime | Date |

efficiency_ratio | float, Optional | Efficiency Ratio is the fractal efficiency of price changes |

kama | float, Optional | Kaufman’s adaptive moving average |

More about Efficiency Ratio(ER): ER fluctuates between 0 and 1, but these extremes are the exception, not the norm. ER would be 1 if prices moved up or down consistently over the er_periods periods. ER would be zero if prices are unchanged over the er_periods periods.

Utilities

See Utilities and Helpers for more information.

Example

from stock_indicators import indicators

# This method is NOT a part of the library.

quotes = get_historical_quotes("SPY")

# Calculate KAMA(10,2,30)

results = indicators.get_kama(quotes, 10,2,30)

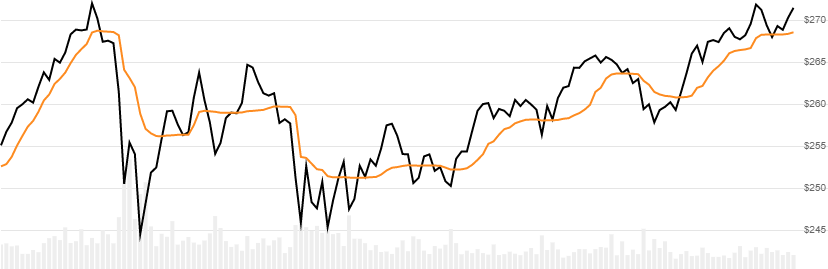

About Kaufman’s Adaptive Moving Average (KAMA)

Created by Perry Kaufman, KAMA is an volatility adaptive moving average of Close price over configurable lookback periods. [Discuss] 💬