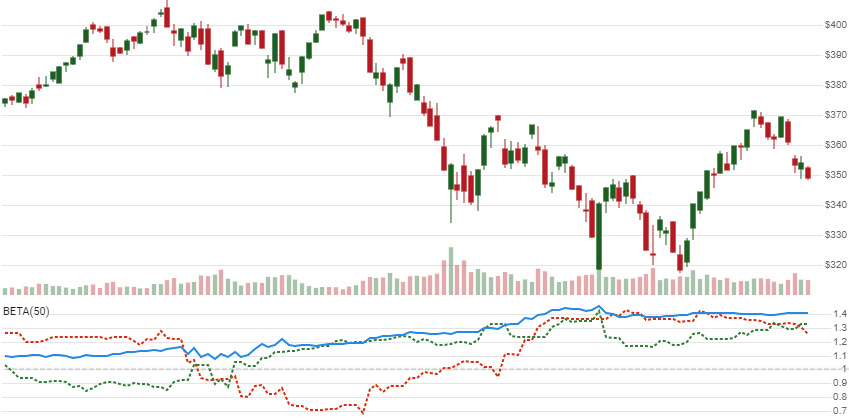

Beta Coefficient

get_beta(eval_history, market_quotes, lookback_periods, beta_type=BetaType.STANDARD)

Parameters

| name | type | notes |

|---|---|---|

eval_history | Iterable[Quote] | Historical [evaluation stock] Quotes data should be at any consistent frequency (day, hour, minute, etc). • See here for usage with pandas.DataFrame |

market_history | Iterable[Quote] | Historical [market] Quotes data should be at any consistent frequency (day, hour, minute, etc). This market quotes will be used to establish the baseline. |

lookback_periods | int | Number of periods (N) in the lookback period. Must be greater than 0 to calculate; however we suggest a larger period for statistically appropriate sample size and especially when using Beta +/-. |

beta_type | BetaType, default BetaType.STANDARD | Type of Beta to calculate. See BetaType options below. |

Historical quotes requirements

You must have at least N periods of quotes to cover the warmup periods. You must have at least the same matching date elements of market_history. Exception will be thrown if not matched. Historical price quotes should have a consistent frequency (day, hour, minute, etc). See the Guide for more information.

BetaType options

from stock_indicators.indicators.common.enums import BetaType

| type | description |

|---|---|

STANDARD | Standard Beta only. Uses all historical quotes. |

UP | Upside Beta only. Uses historical quotes from market up bars only. |

DOWN | Downside Beta only. Uses historical quotes from market down bars only. |

ALL | Returns all of the above. Use this option if you want ratio and convexity values returned. Note: 3× slower to calculate. |

Returns

BetaResults[BetaResult]

- This method returns a time series of all available indicator values for the

quotesprovided. BetaResultsis just a list ofBetaResult.- It always returns the same number of elements as there are in the historical quotes.

- It does not return a single incremental indicator value.

- The first

N-1periods will haveNonevalues since there’s not enough data to calculate.

BetaResult

| name | type | notes |

|---|---|---|

date | datetime | Date |

beta | float, Optional | Beta coefficient based on N lookback periods |

beta_up | float, Optional | Beta+ (Up Beta) |

beta_down | float, Optional | Beta- (Down Beta) |

ratio | float, Optional | Beta ratio is beta_up/beta_down |

convexity | float, Optional | Beta convexity is (beta_up-beta_down)2 |

returns_eval | float, Optional | Returns of evaluated quotes (R) |

returns_mrkt | float, Optional | Returns of market quotes (Rm) |

Utilities

See Utilities and Helpers for more information.

Example

from stock_indicators import indicators

from stock_indicators import BetaType # Short path, version >= 0.8.1

# This method is NOT a part of the library.

history_SPX = get_historical_quotes("SPX")

history_TSLA = get_historical_quotes("TSLA")

# calculate 20-period Beta coefficient

results = indicators.get_beta(history_SPX, history_TSLA, 20, BetaType.STANDARD)

About Beta Coefficient

Beta shows how strongly one stock responds to systemic volatility of the entire market. Upside Beta (Beta+) and Downside Beta (Beta-), popularized by Harry M. Markowitz, are also included. [Discuss] 💬